Tobacco is a sector for which it is common for investors to exclude or underweight the stocks. Anti-tobacco groups encourage this stance. For example, Tobacco Free Portfolios aims to reduce and ultimately eliminate all investment in tobacco. In this context, an underweight position holds an insufficient amount of a particular security compared to the weight of that security in the benchmark portfolio.

Russell Investments found that one-half to three-quarters of the global equity universe was underweight tobacco over the period from 2003 to 2018. In addition, 36% to 62% avoided tobacco completely. In the US, approximately three-quarters of the universe is underweight tobacco in the large-cap equity space, and roughly 50% to 70% avoids tobacco completely. Tobacco exposure over the 2003 to 2018 period declined globally. Despite tobacco stocks having generated an average excess return of approximately 2% over the same period, Russell Investments concludes due to several factors “the notion that excluding tobacco from portfolios is a detriment to performance is overstated.”

In light of release of the Tobacco Transformation Index®, sponsored by the Foundation for a Smoke-Free World, I offer a contrarian view. Contrarian investing is an investment style in which investors purposefully go against prevailing market trends by selling when others are buying and buying when most investors are selling. Many investors will agree that contrarian investing is a difficult discipline to master. When performed correctly, however, this strategy can be very profitable.

According to Russell Investments, most investors do not own tobacco stocks or own less than the applicable benchmark. This position is the consensus view—precisely the type of negative consensus in which a contrarian investor sees opportunity.

For the opportunity to materialize, the investment must ultimately deliver better than anticipated performance through earnings growth. In other words, just because a stock or sector is out of favor does not mean it will necessarily rebound. In the case of tobacco stocks, for which cigarette volumes are rightfully declining, investors correctly question the future revenue model. For investors to ultimately upgrade their views, there must be some type of positive catalyst. Some investors think the long-term performers in tobacco will be those companies with the best reduced-risk products, and current stock valuations are compatible with this view.

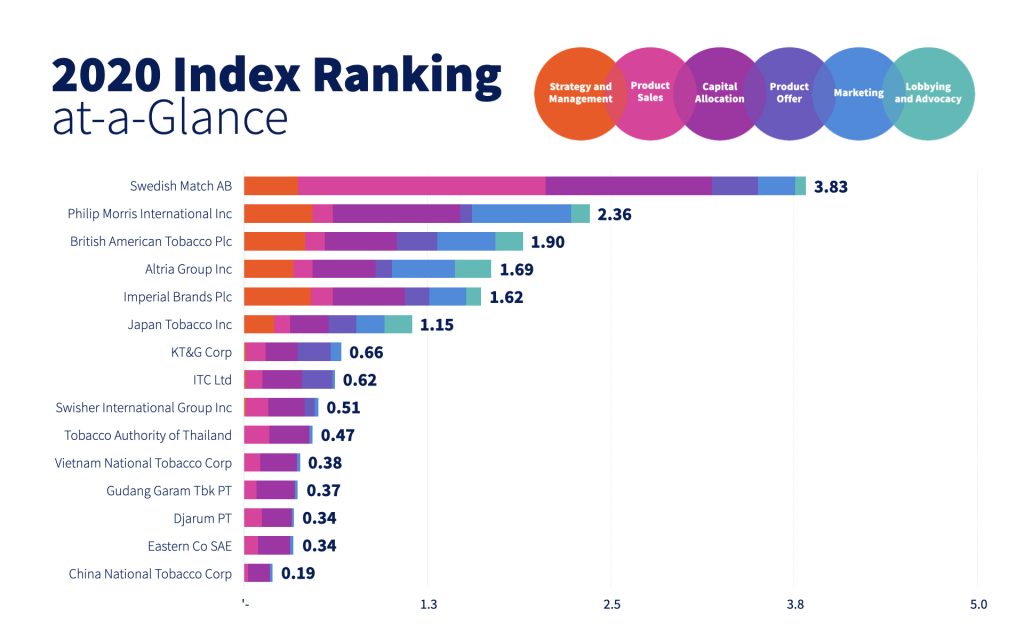

The Tobacco Transformation Index® is a comprehensive evaluation of the 15 largest tobacco companies, with respect to their transition away from combustible cigarettes and other high-risk tobacco products. By tracking companies’ sales, investments, and strategies, the Index is meant to inform investors and ultimately accelerate action to end smoking.

The Index complements and facilitates a broader trend—namely, acknowledgement of the social impact of investing. In conflict with the exclusionary approach of divestment and underweighting common in tobacco investing today, a growing segment of the investor community is developing and applying environmental, social, and governance (ESG) criteria in the investment process, with the aim of positively influencing company behavior. Some investors, like Aberdeen Standard Investments, use their position as shareholders to engage with companies—including the tobacco sector—to address ESG risks and opportunities in their portfolios.

There is little doubt that thinking around how to handle sustainability information is evolving, as witnessed by the recent SASB Symposium. In the tobacco sector, the Tobacco Transformation Index® is establishing a position to enhance the visibility of tobacco companies’ performance, commitment, and transparency across a set of 35 indicators organized according to six categories. As such, it offers investors data and analysis that can help them to better understand and track companies’ activities. In addition, through its methodology, developed following extensive stakeholder engagement, the Index provides a framework that can potentially lead tobacco companies toward a sustainable investing model.

By tracking the activities of tobacco companies, it may be possible to encourage more socially responsible behavior. Ultimately, however, the onus is on company management as to whether they will choose to accelerate the reduction of harm caused by tobacco use. Regardless of the outcome, the Index will monitor and critically evaluate tobacco companies’ behavior over time and hold companies accountable for their actions.

© 2023 Foundation for a Smoke-Free World. All rights reserved.