The Tobacco Transformation Index® measures the extent to which nicotine and tobacco companies are making material progress toward reducing the consumption of high-risk products (HRPs) and contributing to tobacco harm reduction. Nicotine pouches are one of six products defined as “reduced-risk”[1]. As this blog post explores, nicotine pouches are a relatively niche category and not widely available but are developing rapidly in select geographies. The largest markets are currently in the US and other HMICs [2]. Seven of the 15 companies ranked by the Tobacco Transformation Index® currently offer nicotine pouches, as do a number of other companies. Regulatory developments, given current fluidity, will likely be crucial to the category’s future.

Of the 15 companies ranked by the Tobacco Transformation Index®, seven offer nicotine pouches to date. Nicotine pouches are a rapidly growing but relatively small category, representing 0.3% of the world tobacco market by value terms in 2021.

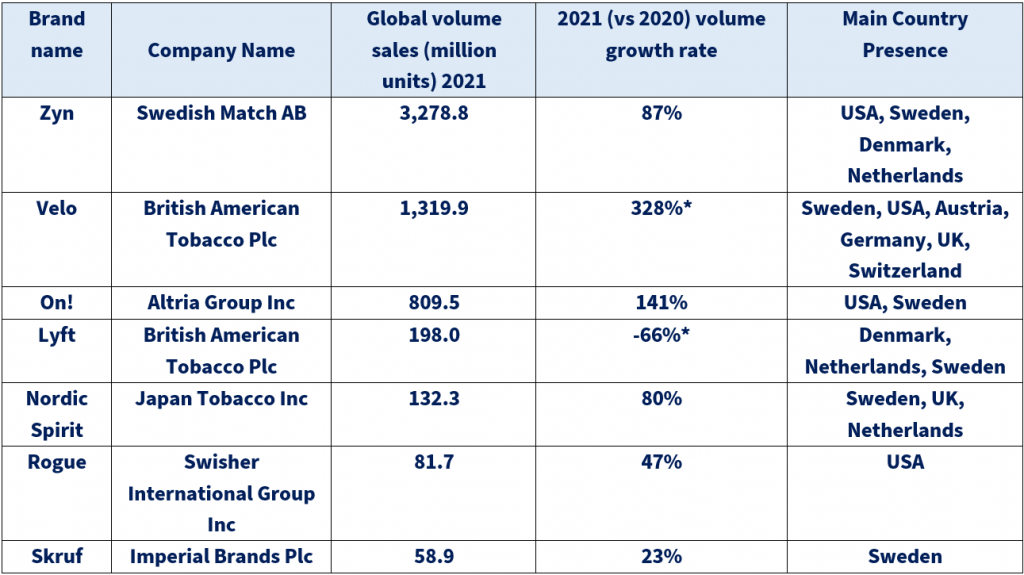

Table 1: Leading Nicotine Pouch Brand Global Volume Sales, Growth, and Country Presence, 2021

Source: Euromonitor International Passport, Tobacco system, published May 2022. Brands ranked high to low based on global volume sales (million units 2021). 1 unit = 1 nicotine pouch

* Since 2020, British American Tobacco (BAT) has been consolidating its product portfolio under the brand name Velo. Lyft was renamed Velo, explaining its negative volume growth rate in 2021.

Countries shown in “Main Country Presence” are ranked high to low by brand’s volume sales in 2021 for volume sales of at least 10 million units.

Not included in Table 1 is Philip Morris International, which acquired AG Snus in May 2021 and its brand Shiro. The brand has a limited market presence in Sweden. Smaller companies are entering the niche market. For example, the UK-based next generation nicotine and CBD manufacturer, V&YOU, launched a new &Boost+ nicotine pouch in September 2021.

The largest nicotine pouch markets are the USA and Sweden, partly a result of oral tobacco products being strongly rooted in the local tobacco culture. From the Index list of countries, the nicotine pouch brands are mostly present in HMICs, except for BAT which sells Velo in LMICs (Indonesia and Pakistan). Swedish Match, global nicotine pouch category leader, continued to increase sales in 2021 in the USA with its brand Zyn [3]. In 2021, Altria Group acquired the remaining 20% global ownership of On! and expanded its retail distribution, which accelerated volume growth of the brand.

In terms of the 36 countries covered by the Tobacco Transformation Index, nicotine pouches are allowed in 24 countries (often considered consumer products by regulatory bodies). Of the 24 markets in 2021, there was notable market size (above 10 million units) in seven: USA, Sweden, UK, Germany, Ukraine, Switzerland, and Poland [4]. Nicotine pouches are sold as consumer products, in contrast to Nicotine Replacement Therapy (NRT) products which require a pharmaceutical license and are traditionally outside of the capabilities of tobacco companies.

In some countries, the legislation is uncertain. Non-tobacco nicotine pouches were banned in the federal state of Bavaria, while Germany’s Federal Office of Consumer Protection and Food Safety (BVL) recognized that the products are not regulated by tobacco law and should not be placed on the market. The BVL stated that nicotine pouches are a foodstuff containing an unauthorized novel food ingredient (nicotine) and thus illegal for sale.

In other countries, nicotine pouches are explicitly banned, such as in Kenya, which banned nicotine pouches in February 2022. BAT launched and then subsequently withdrew Lyft in Kenya.

Elsewhere, nicotine pouches may not have been formally legislated under tobacco product legislation, such as in Mexico. In these instances, no legislation exists regarding the introduction of the product in the market and there is a lack of legislation around the advertising of nicotine pouches.

In the USA, flavored nicotine pouches are currently available across the country, pending FDA review of the premarket tobacco product applications “submitted by the September 9, 2020, deadline”. One of the possible outcomes would be the removal of some or all flavored products from the market. In New York State, there is a possibility that state legislation would ban flavored nicotine pouches.

In Europe, it remains to be seen whether the EU Tobacco Products Directive 3 (unlikely to come into effect before 2025) will provide more guidance on nicotine pouch regulation. In Italy, where nicotine pouch sales are currently relatively small, nicotine pouches will officially fall under tobacco legislation as of January 1st, 2023, and they will be taxed for the first time at EUR 22 per kg.

© 2023 Foundation for a Smoke-Free World. All rights reserved.