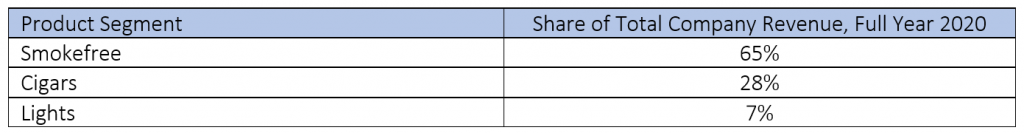

In September 2021, Swedish Match AB announced that it plans to spin off its cigar business and become an entirely “smokefree” company. The spin-off is targeted for completion by the second half of 2022. As Table 1 illustrates, cigars currently represent 28% of Swedish Match’s revenue, with the remainder of its portfolio mostly comprising oral tobacco and nicotine products: snus, moist snuff, chewing tobacco, and non-tobacco nicotine pouches.

Source: Swedish Match 2020 Annual Report, published March 2021, accessed November 2021

Note: Swedish Match’s smokefree segment includes sales of chewing tobacco, Swedish-style snus, US-style moist snuff (“dip”), and tobacco-free nicotine pouches. The cigars segment covers cigars and cigarillos. The lights segment includes matches and lighters

The Tobacco Transformation Index® measures the extent to which companies are making material progress toward reducing the consumption of high-risk products and contributing to tobacco harm reduction efforts. In this context, various aspects of Swedish Match’s announced divestment of its cigar business could be considered by the Index when assessing the effects of the divestment on harm reduction. Since such considerations will ultimately impact Index methodology and determine how any future divestments of high-risk tobacco products are assessed, it is helpful to review Swedish Match’s planned divestment and determine its potentially positive and/or negative impacts on tobacco harm reduction.

A spin-off of Swedish Match’s cigar business would ultimately mean that popular cigar brands such as Garcia y Vega™, Garcia y Vega 1882™, Game™, and White Owl™ would continue to be available to consumers under different ownership. It is also possible that the new entity would, in time, be acquired by another organization, such as a private equity group or privately held company, that does not have a harm reduction agenda. If this is the case, the divestment could have a negative impact on overall harm reduction efforts relative to the status quo of the brands remaining under the control of Swedish Match. Compared to entities whose sole focus is to maximize sales of high-risk products (in this case, cigars), tobacco and nicotine companies with a diverse portfolio of both high-risk and reduced-risk products have a greater incentive to convert their current high-risk product users to their reduced-risk product alternatives .

That being said, it could be argued in this case that there is less overlap between Swedish Match’s cigar and cigarillo consumer base and its oral tobacco and nicotine-product user base. With this in mind, the potential for Swedish Match to drive harm reduction products among its existing high-risk product users may already be limited. Swedish Match could mitigate the potentially negative impact of its cigar business falling into the hands of a private entity with no harm reduction agenda by re-investing the profits from the sale of its cigar business into further driving its harm reduction strategy within its remaining operations.

Finally, it is also important to consider the risk profile* of the products being divested when assessing the potential consequences of a divestment. The relative risk associated with the consumption of cigars is of consequence, but it is estimated to be smaller (due in part to lower usage) than that of cigarettes. The relative risk estimated with the consumption of cigarillos more closely aligns with that of cigarettes. In the case of Swedish Match, cigars represent approximately 23% of the company’s total retail value sales, whereas cigarillos represent around 4%.**

As stakeholders have advised during consultations, ultimately it is imperative for the Index to measure outcomes versus intentions. In a divestiture of this nature, consumer outcomes will be determined in part by the actions of both buyer and seller (in this case, Swedish Match) over time.

The Tobacco Transformation Index® is predicated on the view that continuous evolution and improvement of the underlying methodology of its analyses is essential for enhancing the relevance and impact of the Index for each future cycle, and to further accelerate the reduction of harm caused by tobacco use over time. The Index is therefore committed to developing a transparent, holistic framework by which to assess divestment activity related to high-risk products. The objective is to assess the degree to which such activity is likely to impede, or further contribute to, industry and consumer transformation. Assessment criteria may include, among other aspects:

Ultimately, there is no single, preferred approach. Each individual divestment action must be assessed in its own context and a determination made by the Index as to how it should be treated through Index scoring. As the Index team continues to develop a framework for assessing this type of divestment activity, comments from stakeholders are welcomed. We invite readers to submit their thoughts and comments on this topic and others by contacting us at this email address: comments@tobaccotransformationindex.org

* Reduced-risk/high-risk product definition is based on a relative risk hierarchy (RRH) produced by Rachel Murkett et al, October 2020, based on a systematic review of the scientific literature and analysis of the best available evidence.

** Source: Euromonitor International Passport, 2019, estimates using inputs including company reports and statements

© 2023 Foundation for a Smoke-Free World. All rights reserved.