Revised December 15, 2022

The Tobacco Transformation Index® aims to accelerate the reduction of harm caused by tobacco use. The Index ranks the world’s 15 largest tobacco companies on their relative progress toward harm reduction.

The Index is designed to deliver on key goals of the Foundation: to drive the transformation of tobacco companies for the benefit of public health, and to inform the public about tobacco industry activities that have an influence on the achievement of a smoke-free world.

The 2022 Index demonstrates that the transformation of the tobacco industry toward harm reduction continues to be inconsistent and at an early stage.

The 2022 Index demonstrates that differentiation is forming across the largest tobacco companies in the areas of commitment, performance, and transparency. As a component of the Index theory of change, highlighting differences in behavior across tobacco companies helps to inform stakeholders and enables them to better drive change.

The 2022 Index demonstrates that momentum toward tobacco harm reduction is developing across a subset of the 15 Index Companies, albeit at varying degrees. Individual companies at the lowest ranks of the 2020 Index made or evidenced potential commitments to introducing or expanding the range and/or volume of reduced-risk products (RRPs) within their respective product portfolios. Time will tell if transformation comes to fruition.

Index research indicates that high-risk products (HRPs)—cigarettes and combustible tobacco—accounted for about 95% of Index Company retail sales by volume in 2021. RRPs accounted for only 5%.

The Index methodology is grounded in the concept of relative risk assessment based on a systematic review of scientific studies of the health risks associated with nicotine products. The assessment was updated for the 2022 Index. The review identified cigarettes and combustible tobacco as the most harmful of the 15 nicotine products studied.

In summary, the vast majority of what the tobacco companies sell are the most harmful products. There is a long way to go to achieve meaningful harm reduction.

Furthermore, for the 15 Index Companies combined, in 2021 about 97% of RRP sales, on a per-stick equivalent basis, were in high-medium income countries (HMICs), with only 3% in low-medium income countries (LMICs). In other words, the RRPs are not available where the majority of smokers live and where the need is the greatest.

The company-country analysis report series assesses the 15 tobacco companies in the Tobacco Transformation Index at a country level on activities related to tobacco harm reduction. The Index covers 36 countries globally that account for approximately 85% of the current global population of adult smokers. RRP products are grouped into six categories: cartridges, e-liquids, heated tobacco products (HTPs), non-tobacco nicotine pouches, nicotine-replacement therapy products, and Swedish-style snus.

Across the 15 companies, 36 countries, and six RRP categories, the Index analysis finds:

One constraint on accelerating harm reduction is tobacco companies’ lack of ability to legally sell RRPs due to governmental bans in certain countries, influencing company actions at the country level. For example, among the 36 countries included in the study:

At least three of six RRP categories are prohibited in nine countries (the seven listed above plus India and Japan).

Nicotine and tobacco product bans are part of the story—but so are tobacco company actions.

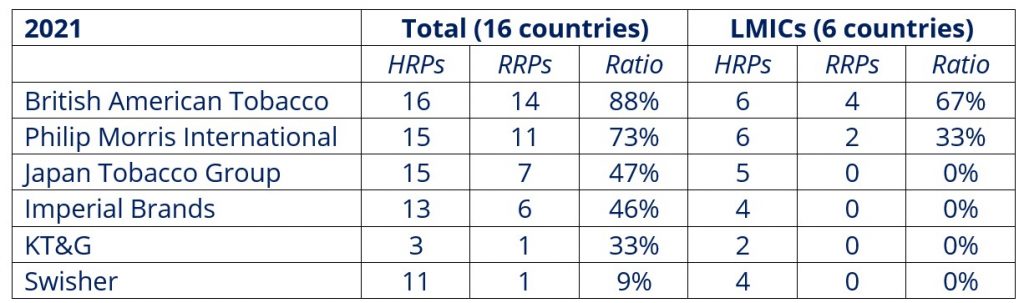

Of the 36 countries covered by the Index, three RRP categories—HTPs, e-vapor, and nicotine pouches—were legal in 16 of the 36 countries in 2021. Of the 16 countries, six are LMICs. The three product categories are identified for the analysis because of their relevance in the reduced risk assessment, as well as their availability in company portfolios. The analysis studied the six tobacco companies that sell HRPs in multiple countries.

Table 1 demonstrates that in countries where the tobacco companies sell HRPs, British American Tobacco and Philip Morris International offered RRPs in 88% and 73% of the countries, respectively. Japan Tobacco Group and Imperial Brand offered RRPs in about half of those markets, with KT&G at 33% and Swisher at 9%. In LMICs, only British American Tobacco and Philip Morris International offered RRPs in countries where the products are legal.

Of course, market presence is not the same as product sales volume, and cigarettes remain the dominant category. However, such performance indicates a divergence in strategy and execution across the largest tobacco companies.

Number of Countries in Which Company Offers HRPs and RRPs and Where HTPs, E-Vapor, and Non-Tobacco Nicotine Pouches Were Legal in 2021

Source: Euromonitor International 2022

Note: HTPs, e-vapor, and non-tobacco nicotine pouches were legal in 2021 in the following HMICs: Bulgaria, France, Poland, Saudi Arabia, South Africa, South Korea, Sweden, Switzerland, United Kingdom, and the United States. They were legal in the following LMICs: Bangladesh, Egypt, Indonesia, Nigeria, Pakistan, and the Philippines. Analysis excludes China, Myanmar, Ukraine, and Vietnam due to industry structure or geopolitical factors.

Through this type of research, the Tobacco Transformation Index increases knowledge about tobacco company activities, where the activities are taking place, and how tobacco company behavior is (or is not) changing. The Index provides a means to monitor and report on company activity over time. Greater knowledge supports all stakeholders in driving positive change.

© 2023 Foundation for a Smoke-Free World. All rights reserved.