The Tobacco Transformation Index® demonstrates that the transformation of the tobacco industry toward harm reduction is at an early stage. Simply put, the tobacco industry is not phasing out high-risk products (i.e., cigarettes) and/or transitioning smokers to reduced-risk products quickly enough to achieve the Foundation’s mission of ending smoking in this generation.

The 2022 Index, which covers the review period 2019-2021, illustrates that differentiation is occurring in the largest tobacco companies, as shown by measures of commitment, performance, and transparency.

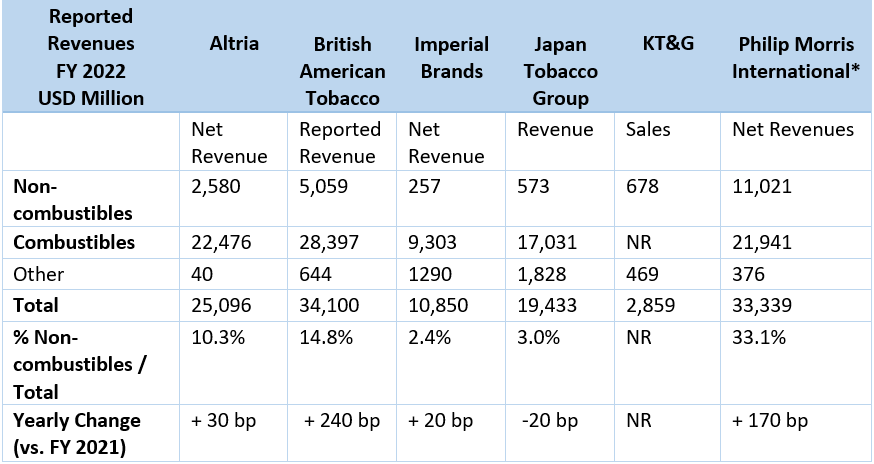

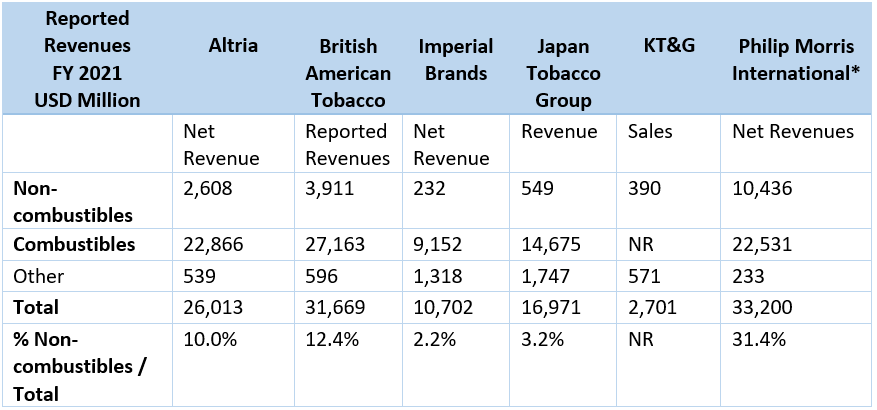

Review of the full-year 2022 results associated with the six highest-ranked Index Companies indicates that reduced-risk products continue to form a limited, albeit growing, share of total revenue. Note that Swedish Match AB was acquired by Philip Morris International in November 2022 and is therefore excluded from the analysis. Results for Philip Morris International are presented pro forma.

Based on reported revenues for full-year 2022, Philip Morris International pro forma, British American Tobacco Plc, and Altria had the largest non-combustibles portfolios. As identified through Index research, sales value figures can vary proportionately relative to sales volume figures. The Index methodology weights the sales volume figures more heavily as indicative of consumer harm.

KT&G Corporation, Japan Tobacco Group, and Imperial Brands Plc had lower non-combustibles sales.

British American Tobacco and Philip Morris International pro forma progressed, on the basis of yearly change in percentage non-combustibles, while the others were relatively stagnant. The 2022 financial results will be picked up by the next release of the Index later in 2024.

For 12 months ended December 31, 2022 (except Imperial Brands at 12 months ended September 30, 2022)

Source: Company annual and quarterly reports (figures for Altria, British American Tobacco, Imperial Brands, Japan Tobacco Group, KT&G, Philip Morris International, and Swedish Match converted to USD)

* Pro forma: Philip Morris International revenues combined with revenues reported by Swedish Match for first quarter to third quarter 2022 and full-year 2021 converted to USD.

bp = basis points; NR = not reported

Based on the most recently published full-year 2022 and fourth quarter 2022 reports, Philip Morris International pro forma derives more of its value sales from non-combustible products (33.1%), followed by British American Tobacco (14.8%), and Altria (10.3%). Japan Tobacco Group and Imperial Brands lag behind with 3.0% and 2.4% share, respectively. KT&G results were not reported at the time of writing.

British American Tobacco registered the largest ratio increase of 240 basis points for percentage of total revenues derived from non-combustibles in 2022, compared to 2021, followed by Philip Morris International at 170 basis points.

British American Tobacco’s growth in non-combustibles share of total revenue is driven by sales of e-vapor products, heated tobacco products, and non-tobacco nicotine pouches. Philip Morris International non-combustibles revenue in full-year 2022 is primarily driven by its heated tobacco IQOS product, counting 24.9 million users in 2022, reflecting HEETS (consumable) and device sales. Pro forma results include its acquisition of Swedish Match (snus and ZYN non-tobacco nicotine pouches). KT&G’s increase in sales of non-combustibles in 2022 is driven primarily by its heated tobacco devices Lil and heated tobacco consumables Fiit. KT&G has worked with Philip Morris International to launch Lil in more than 30 markets globally. Altria’s modestly increasing share of non-combustibles as a share of total revenue is largely due to sales of US-style moist snuff, driven by its brands Copenhagen and Skoal and its nicotine pouch brand on! Again, from the Index perspective, sales value measures differ relative to volume measures.

On the other hand, Imperial Brands’ limited increase in non-combustibles as a share of total revenue results from increased value in sales of combustibles in 2022 in the Americas.

Japan Tobacco Group did not make material progress over the period, as reflected by its declining share of total revenue derived from non-combustible products. This result is due to a greater increase in combustibles than in non-combustibles revenues for full-year 2022 over full-year 2021.

As highlighted by previous Index research, the full-year 2022 results again demonstrate that the tobacco industry is not a monolith, but rather a group of individual companies with differing strategies, footprints, and degrees of operating prowess.

Reduced-risk product definition based on Nicotine Products Relative Risks Assessment (Murkett et al., September 2022), a systematic review of the scientific literature and analysis of the best available evidence.

Exchange rates taken from Euromonitor International’s Passport database, average exchange rates across 2022.

1 USD | = 0.811 GBP |

1 USD | = 131.5 JPY |

1 USD | = 10.11 SEK |

1 USD | = 1,292.1 KRW |

© 2023 Foundation for a Smoke-Free World. All rights reserved.