This page was last edited on: January 5, 2023

24% (2019)

(Figure 1) Smoking of tobacco products by sex and age, France, 2014 and 2019

Current Female Smokers by Age Group

2014- 2019

(Click to enlarge)

Source: EUROSTAT 2019

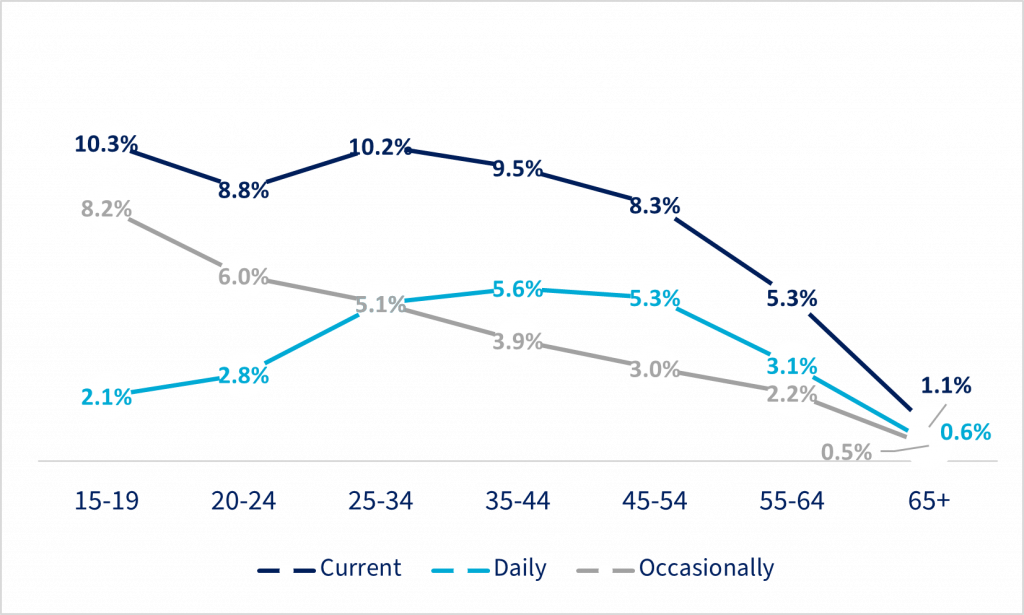

(Figure 2) Use of electronic cigarettes by age groups, France, 2019

Source: EUROSTAT 2019

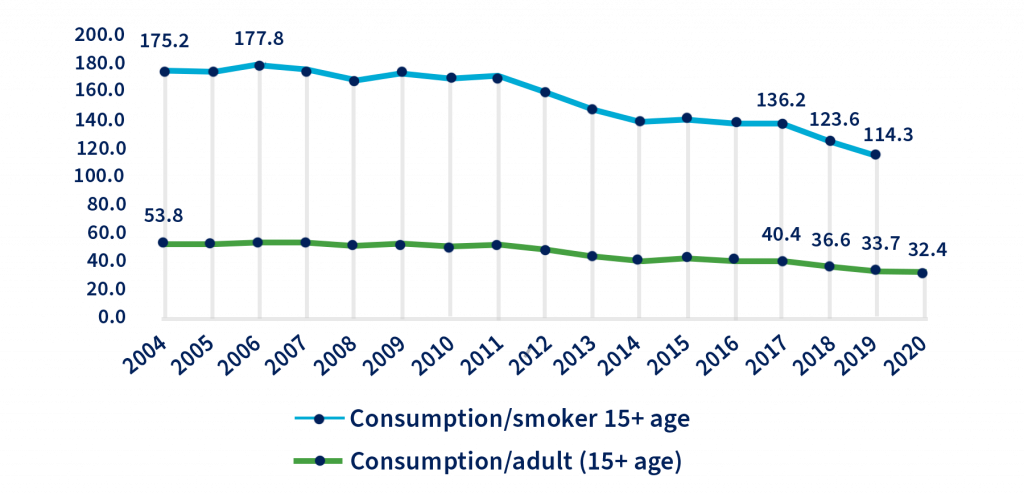

(Figure 3) Cigarette consumption (Packs) per smoker/adult (age 15+), France, 2004 – 2020

Source: Cigarette consumption by Europa. EU (last accessed in August 2022), number of smokers by GBD IHME database 2019 and 15+ population extracted by WB HNP database

(Figure 4) Excise and VAT share (%) on Price of Cigarettes and HTPs

(Figure 5) Tax revenue from tobacco products (millions EUR), France, 2008 – 2020

Source: European Commission, August 2021

(Figure 6) Cigarette excise revenue (million EUR) and illicit trade (%)

Source: Euromonitor International 2022, European Commission, August 2021

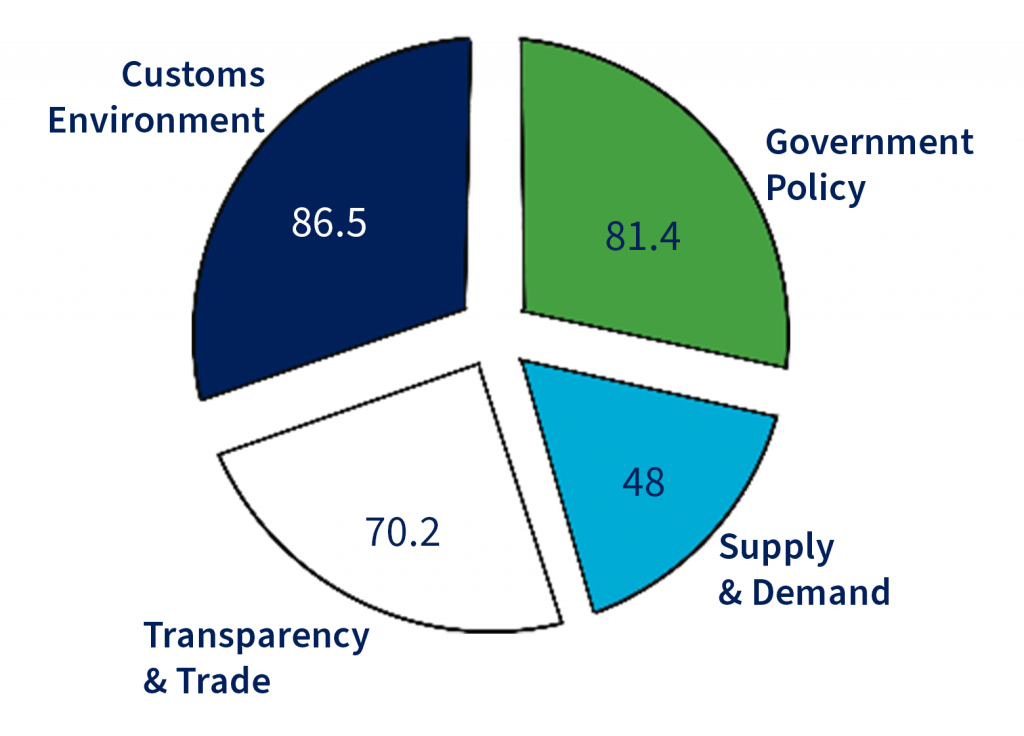

(Figure 7) Illicit Trade Environment Index, France

Main Categories of ITEI & France’s Score

[1] Adult population (15+ age) was 54.2 million in 2014 and 55.4 million in 2019. Data accessed in January 2023.

[2] Population for male (15-19 years old) was 1,908,356 in 2014 and 1,990,884 in 2019, and population for females (15 – 19 years old) was 2,005,114 in 2014 and 2,103,368 in 2019. Data accessed in January 2023.

[3] Specific is €0.62/pack and ad valorem €3.60, a total excise value of €4.22/pack of 20 pieces.

[4] The index is a measure of the extent to which economies enable or inhibit illicit trade through their policies and initiatives to combat illicit trade.

[5] Government Policy measures the availability of policy and legal approaches to monitoring and preventing illicit trade.

[6] Customs Environment measures how effectively an economy’s customs service manages its dual mandate to facilitate licit trade while also preventing illicit trade.

[7] Transparency & Trade measures an economy’s transparency as regards illicit trade and the degree to which it exercises governance over its free-trade zones (FTZs) and transshipments.

[8] Supply & Demand measures the domestic environment that encourages or discourages the supply of and demand for illicit goods, including the level of corporate taxation and social security burdens, the quality of state institutions, labor market regulations, and perceptions of the extent to which organized crime imposes costs on business.

As research findings become available that are inclusive of additional gender identities, the Foundation will update the information presented.

© 2023 Foundation for a Smoke-Free World. All rights reserved.